Master Your Money with the Top Apps for Financial Planning

Welcome to your smart money launchpad, where clarity meets action and every tap turns into progress. Selected theme: Top Apps for Financial Planning. Explore how the right tools can simplify decisions, reduce stress, and help you move confidently toward your biggest financial goals.

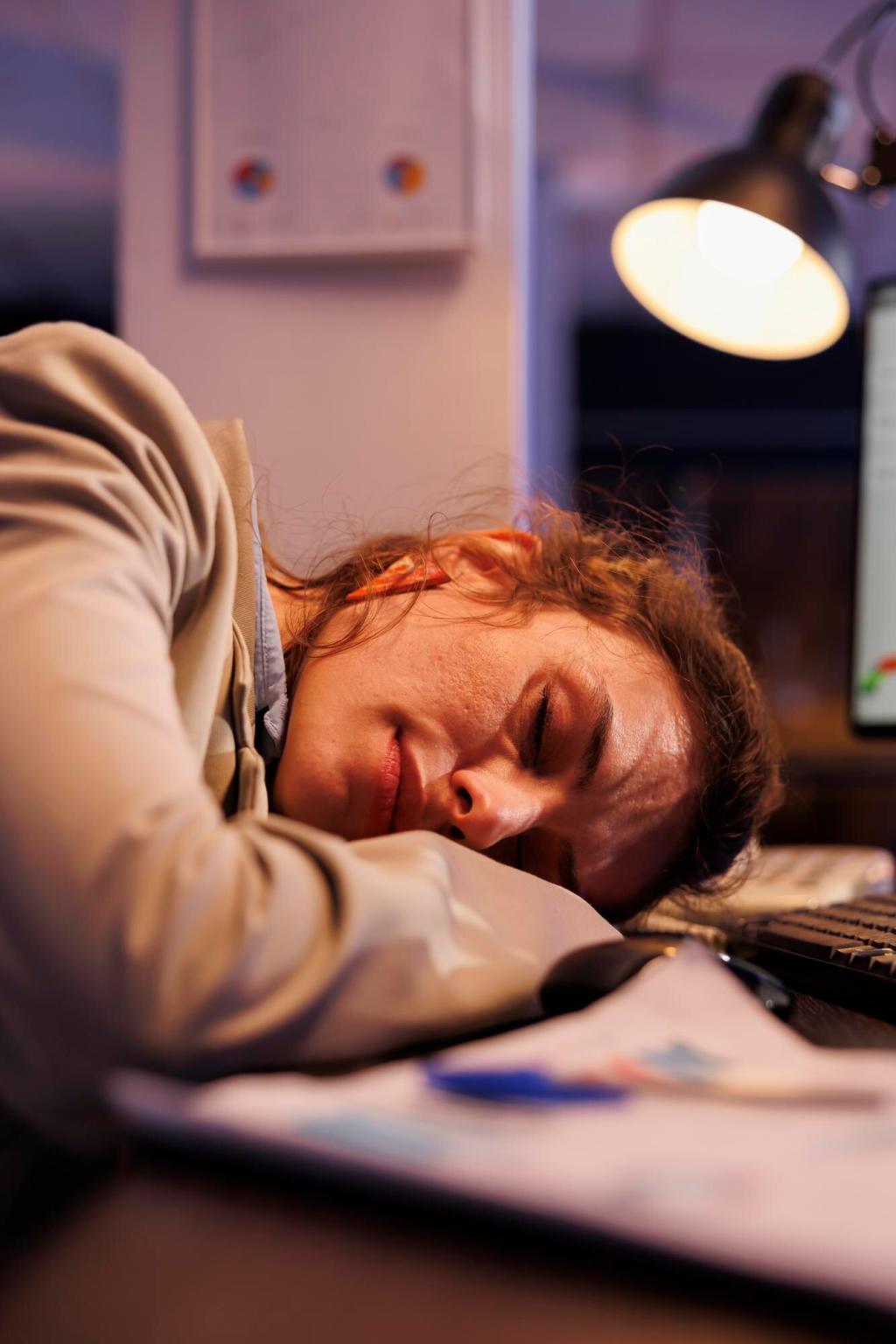

Spreadsheets still have a place, but top apps for financial planning transform scattered accounts into one living dashboard. See budgets, investments, savings, and debt trends update automatically, so decisions happen with clarity rather than guesswork and late-night mental math.

Why Top Apps for Financial Planning Matter Now

With live balances and categorized transactions, you catch patterns early: subscriptions auto-renewing, categories over budget, and investment drift. Timely nudges help you fix small issues before they grow, keeping your plan steady through everyday spending and surprise expenses.

Why Top Apps for Financial Planning Matter Now

How We Evaluate the Top Apps for Financial Planning

01

Security and Privacy First

The strongest contenders use robust encryption, read-only connections, and transparent data policies. Look for clear permission controls and independent audits. If an app respects your privacy, it will explain what data it collects, why it matters, and how you can revoke access easily.

02

Value, Clarity, and Outcome Focus

Top financial planning apps earn their keep by saving time, preventing costly mistakes, and turning intentions into repeatable habits. Seek clear features that directly support your goals: automated categorization, goal tracking, forecasting, and helpful insights you can actually act on every week.

03

Integration and Automation Power

The best apps play nicely with your banks, brokerages, and digital wallets. Automations move money toward goals the moment you get paid. Reliable syncing, flexible rules, and clean exports ensure your financial planning stays consistent across budgeting, investing, and long-term projections.

Budgeting Plus Investing: A Powerful Pair

Use a budgeting app to control daily cash flow and a planning-focused investing app for long-term allocation. When spending and saving align, contributions become automatic and consistent. This pairing turns scattered intent into a smooth pipeline from paycheck to portfolio growth.

Debt, Credit, and Cash Flow Together

Add a debt tracker to visualize payoff timelines and a credit monitoring tool to catch errors early. When your cash flow app highlights surpluses, funnel them directly toward principal. The combination makes progress measurable, motivating, and visible every week and month.

Backups and Redundancy Strategy

Keep exports of transactions, categories, and plans in secure cloud storage. If an app changes direction, you can migrate swiftly without losing history. Redundant backups protect the story behind your progress, ensuring your financial planning evolves without painful data setbacks.

Stories from the Dashboard: Wins with Top Apps for Financial Planning

Lina’s Debt Snowball Breakthrough

Lina connected all accounts, spotted small leaks, and automated weekly transfers to her highest-interest card. The app’s payoff timeline turned abstract debt into a visual countdown. Three months in, she messaged our community celebrating her first card closed ahead of schedule.

A Freelancer Tames Irregular Income

Sam routed incoming payments through an app that auto-allocated taxes, operating costs, and savings. Forecasts handled dry spells, while alerts flagged late invoices. That structure turned unpredictability into a calm system, and Sam finally felt confident scheduling consistent investing every month.

First-Home Fund, Finally Moving

Maya and Theo linked checking, savings, and brokerage accounts. Goal visualizations showed how weekly round-ups and monthly transfers stacked up. Seeing a rising progress bar on their home fund made dinners feel hopeful instead of anxious, and they invited friends to join our newsletter.

Set rules that move leftover category funds to savings every month, or round up purchases into investment contributions. Triggers attached to payday can allocate money before it disappears. Tiny, automated actions transform sporadic good intentions into a reliable flow toward your priorities.

Data Security in the Era of Top Financial Planning Apps

Use apps that encrypt data in transit and at rest, and prefer read-only connections for aggregation. This limits risk while still enabling complete views. If manual transfers are required, separate credentials and enable alerts to track any suspicious access attempts immediately and confidently.

Weekly Money Review Ritual

Spend fifteen focused minutes: categorize odd transactions, check goal progress, and skim forecasts. Small corrections made weekly prevent big corrections later. Share your routine with us, and subscribe for templates designed specifically for the top apps for financial planning you already use.

Metrics That Motivate, Not Intimidate

Track a few leading indicators: savings rate, debt payoff velocity, and contribution streaks. Avoid overwhelming dashboards stuffed with vanity numbers. The right metrics in your apps create momentum, celebrate wins, and point you to the next action when motivation wavers unexpectedly.

Join the Conversation and Shape Future Guides

Tell us which features you rely on and where you get stuck. Comment with your setup, or request deep dives on specific tools. Subscribe for new walkthroughs that help you get more from the top apps for financial planning, week after week.