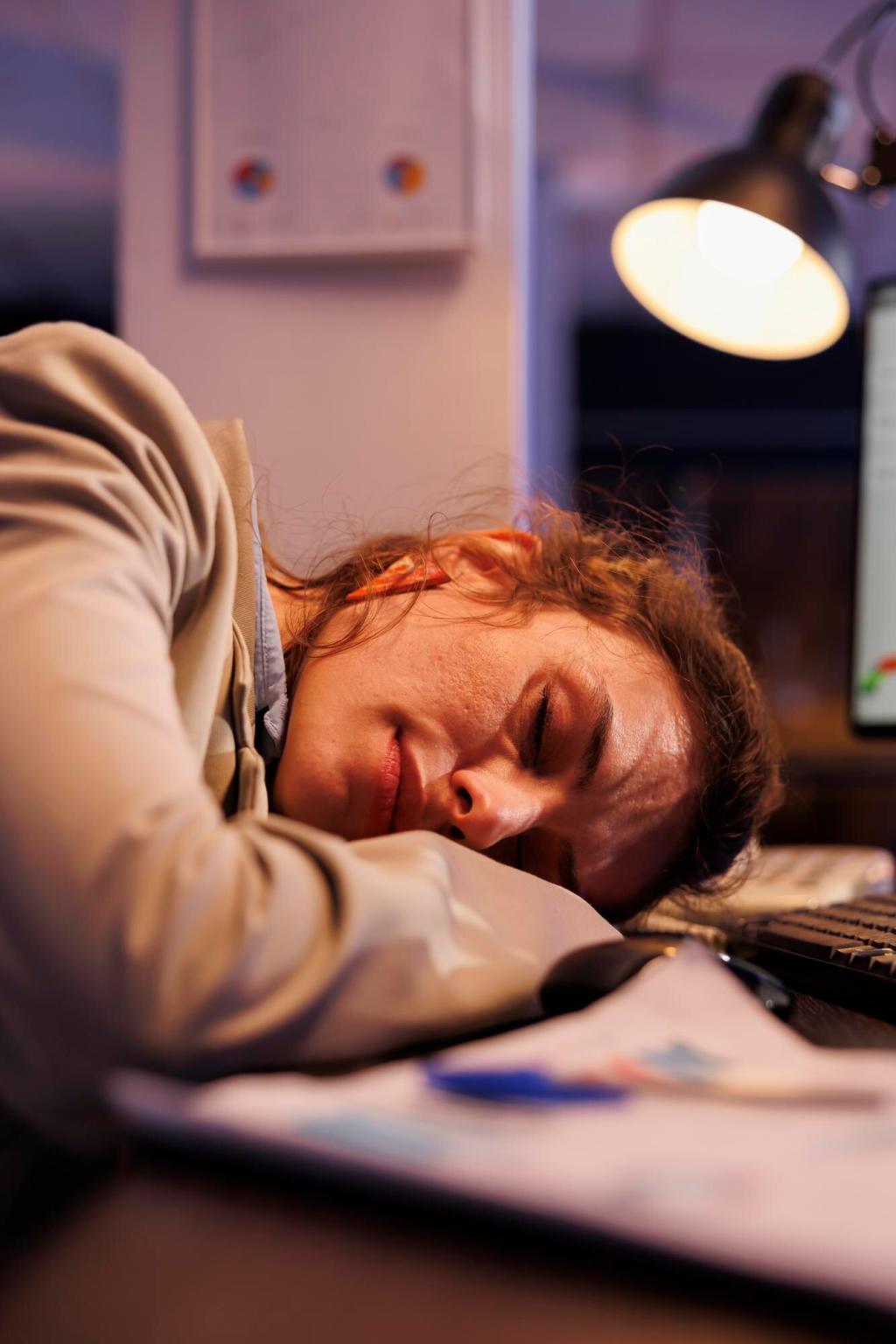

Tackle Debt and Grow Savings with Apps

Enter balances and rates, then compare payoff timelines. Choose snowball for momentum or avalanche for interest efficiency. Watch charts shrink monthly to reinforce effort. Comment which method you picked and why—it helps new readers decide.

Tackle Debt and Grow Savings with Apps

Activate purchase round-ups to sweep spare change into debt or savings. Jamie paid down a card two months early just by rounding up grocery runs. Try it for thirty days and share your total; we’ll compile community results.