Streamlining Expenses with Technology

Chosen theme: Streamlining Expenses with Technology. Welcome to a practical, human-first guide to cutting busywork, revealing real numbers, and building confident money habits with smart, secure tools that fit your life and work.

Why Streamlining Expenses with Technology Matters

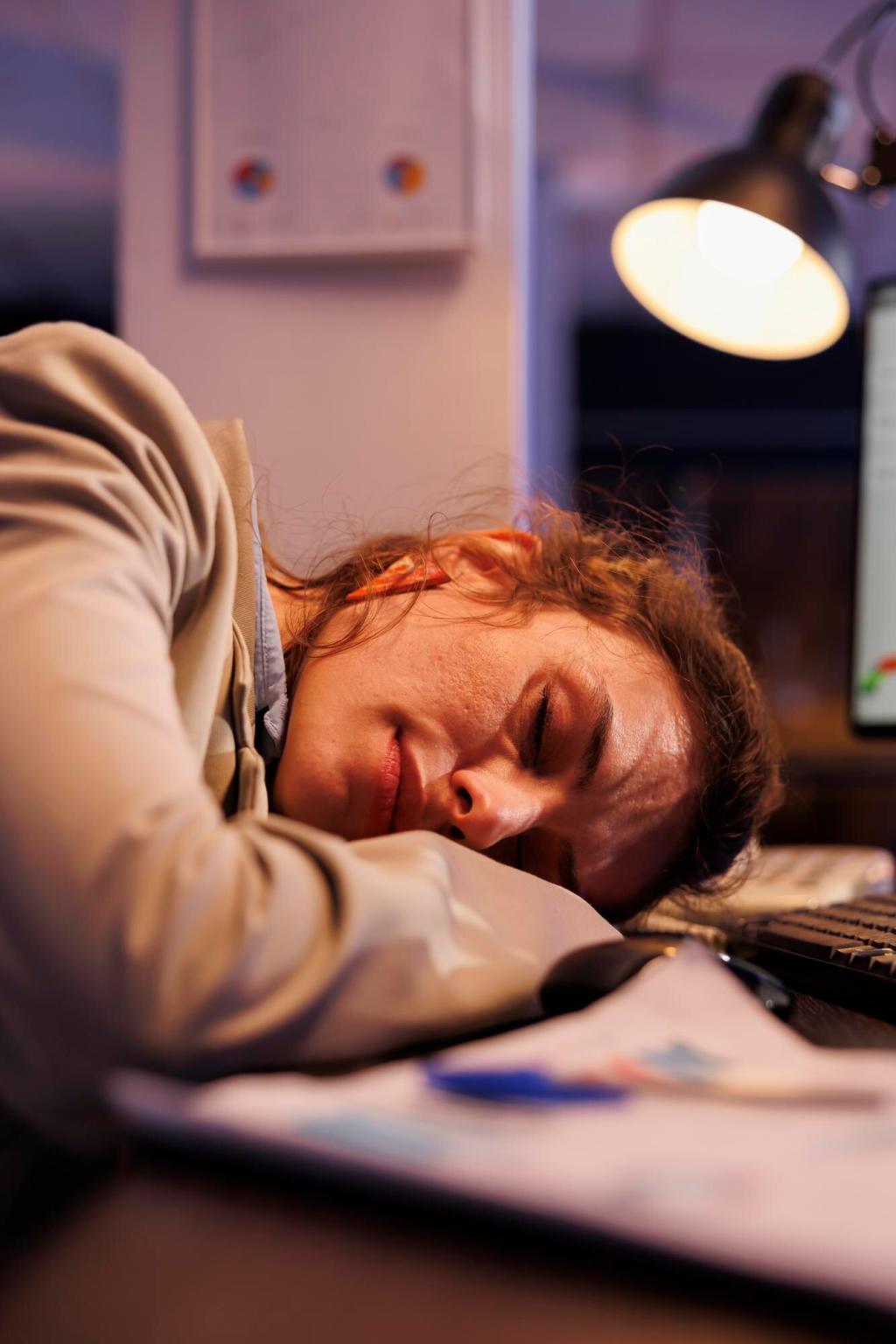

Every hour you save on receipts and reimbursements multiplies across your team. Less copy‑pasting, fewer mismatches, and faster approvals create space for better decisions, calmer month‑ends, and projects that launch on time rather than waiting on spreadsheets.

Receipts used to live in pockets, emails, and a fading pile on the desk. With modern capture and search, a few taps turn crumpled paper into clean, categorized data, ready to audit, reconcile, and analyze whenever questions—or tax season—arrive.

Instant category summaries and trend lines reveal which costs actually drive outcomes. When spend becomes visible in context, you can negotiate subscriptions, shift budgets proactively, and invite your team to suggest improvements. Share your wins in the comments and inspire others.

Integrations That Save Time

Sync categories, vendors, taxes, and projects to your accounting software. When mappings match on both sides, reconciliations are smoother and reports align. Fewer surprises mean better conversations with bookkeepers and stakeholders during reviews and planning sessions.

Integrations That Save Time

Tag expenses to clients and projects at capture, not month‑end. That single habit speeds invoicing and reduces missed billables. Connect your project board so time, materials, and receipts travel together, giving everyone one place to verify scope and costs quickly.

Integrations That Save Time

Automate reimbursements to bank accounts after approval, and issue virtual cards with spend limits for recurring vendors. This contains risk, clarifies responsibility, and generates better data. Tell us which integration saved you the most clicks—we love concrete examples.

Metrics That Matter

Cycle time from purchase to reimbursement

Measure how long an expense takes to move from swipe to payout. Shorter cycles improve morale and visibility. Identify bottlenecks—missing receipts, unclear approvers, or overly strict rules—and address one at a time to create steady, compounding improvements.

Policy compliance without the policing

Monitor exception rates and the percentage of auto‑approved items. Clear policies plus helpful reminders beat after‑the‑fact scolding. Share the “why” behind guidelines so teams make better choices naturally. Celebrate improvements publicly to reinforce the culture you want.

Forecasting cash flow with near‑real‑time spend

Use live feeds and category trends to project upcoming costs. It won’t be perfect, but it will be timely. Small, early adjustments beat big, late corrections. Post your favorite lightweight forecasting tip in the comments to help others get started.

List your current inputs: cards, receipts, email invoices, and reimbursements. Note where errors appear and what takes the longest. Choose one tool for capture, one for approval, and connect a bank feed. Keep scope small so you actually finish.